In this blog, we are going to discuss What is transactional funding? How does it work? Example, and about double closing in detail.

What is transactional funding?

Transactional funding is a short-term loan or fund that is borrowed and repaid rapidly. Generally, it is borrowed and repaid the same day but sometimes up to a week.

The ability to obtain this type of short-term financing helps real estate wholesalers acquire and sell properties swiftly without spending any of their own money. With transactional funding, real estate wholesalers can take title to a property and resell it the same day to another buyer at a higher price. This unique financing technique offers the short-term financing required to facilitate a back-to-back transaction for a real estate wholesaler.

What is extended transactional funding?

Extended transactional funding is another loan type in which an investor/wholesaler can acquire transactional funding to purchase property from the seller and sell it to the end buyer within a specific period.

The primary distinction between transactional funding and extended transactional funding is the second closing might take up to 6 months or 180 days of transactional funding. This funding is suited for deals that need a holding time before transferring title to an end buyer.

Other types of extended transactional funding include 30-day transactional funding, 60-day transactional funding, and 90-day transactional funding.

How transactional funding works?

Transactional funding is typically available from a hard money lender or private money lender. Similarly, it is only utilized when a pre-existing and well-documented final buyer exists. The end buyer should be prepared to purchase the underlying real estate property from the wholesaler as soon as the wholesaler acquires it from the original seller, and the sale profits from the end buyer are used to repay the transactional funding loan.

Transactional funding may be used for any type of residential or commercial real estate transaction, as long as the closing agent is prepared to coordinate both transactions and the lender can verify all required documentation before disbursing the funds.

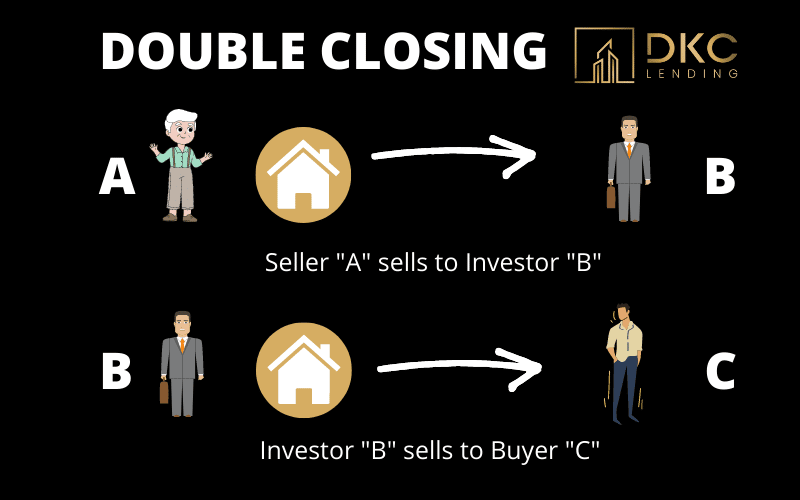

How to use transactional funding for double close?

Working as a wholesaler of properties is one way of getting started in real estate investing. The benefit is that you may connect sellers and buyers while generating a profit for yourself. Furthermore, you mitigate resale risks by not holding the property long-term.

A double closing occurs when two real estate transactions buy and sell concurrently and often include three parties: the original seller, the wholesaler/investor, and the eventual buyer. The wholesaler/investor handles both closings.

The investor/wholesaler effectively serves as a go-between. The investor must be well-organized to manage the complexities of a double closing.

Can I transactional fund in Florida?

A double closing is permitted in Florida as long as investors do not use the end buyer’s purchase

money to support their acquisition of the subject property from the original seller. As a result,

investors must put up their own money to complete the A to B purchase.

Why is DKC best transactional funding provider in Florida?

We at DKC lending are reliable lenders with significant expertise in the real estate investment market. Also, we have over 15 years of lending experience. Our goal is to create a win-win-win scenario for the investor/wholesaler/DKC.

Our pricing and fee structure is as follows:

- Fast Funding: Funding in 24-48 hours. (1 day funding)

- LTV: 100% Financing

- Origination fee: 1-3%

- $50,000-$5,000,000 loan size

- No upfront fees

- No fees if the transaction does not close.

What is a transactional funding example?

Let’s walk through an example of transactional funding to understand it more fully. Let’s say you’re a wholesaler working with a buyer and seller. You find a seller who wants to move to Arizona from Florida. At the same time, you will find a potential buyer who wants to buy a property in Florida. You identify a property that the seller is selling. After negotiating the price with the seller, you finalize the purchase price at $400,000.

You put the property under contract such that the property will be sold from your seller to your buyer for $450,000. You then secure a transactional loan from transactional funding lenders for $400,000, coordinate closing dates, and secure a $50,000 profit before transactional funding costs that are paid to the lender at closing. This simplified example demonstrates how a real estate investor can quickly buy and sell a home without traditional closing costs, real estate commission, and transaction fees, all of

which could cost as much as 15% of the sale price. With transactional funding, the real estate investor can easily buy and sell a property without spending any of their own money.

What are the benefits of transactional funding?

- Lower Risk: Real estate investors and wholesalers have less risk because the transactional funding lender provides 100 percent of the loan amount to acquire a property.

- Simplified Processing: The paperwork is simple, and most transactions do not require your credit score. Transactional finance does not typically require the same underwriting requirements as a conventional or hard money mortgage loan does.

- Quick Processing/closing: All you need is a letter of proof of finances from the end buyer of your desired real estate property. In only a few days, you may have your transactional money authorized and at the closing table.

- 100% Financing: Transactional funding covers the whole purchase price plus closing fees, allowing for true no-money-down real estate transactions.

What is wholesaling transactional funding

When selling wholesale properties to investors instead of end-users, transactional funding is frequently beneficial. The wholesaler or investor can obtain the funds required to close a transaction and then swiftly resell the acquired property for a profit in a separate transaction with an end-user.

This funding approach provides greater flexibility to investors and can replace the assigning contracts technique in traditional transactional funding. Transactional funding, extended transactional funding, and wholesaling transactional funding is extremely beneficial to real estate wholesalers because of their timeliness and cost benefits.