What is Double Closing?

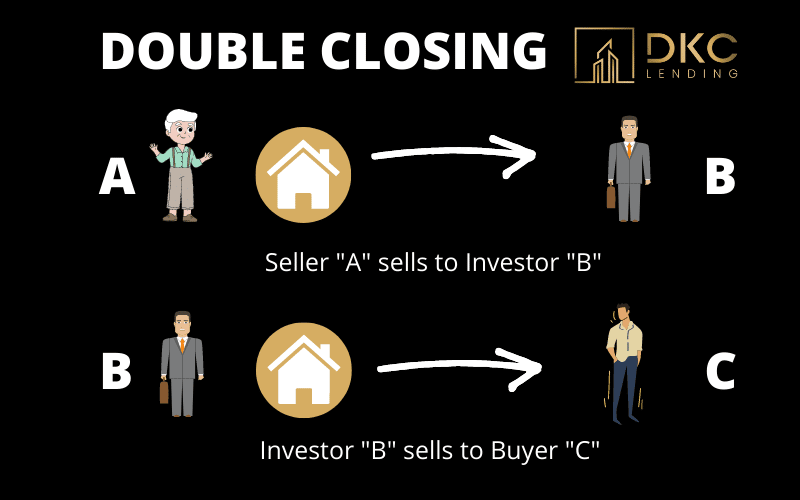

A double closing is a simultaneous process of purchasing a real estate property that involves the original seller, end buyer, and an investor (middleman). Ultimately, a double closing makes you the ‘middleman.’

The underlying reasons for having a double closing vary. The most pressing and usual reason is to allow the middleman to use the purchasers funds to acquire the property from the original seller. Another common reason for a double closing is to conceal the identity of the purchaser or seller.

Typically, a real estate investor first enters into a contract to purchase a property and then subsequently (before closing the purchase) enters into a contract to sell the property (hopefully for a higher price). The investor then utilizes a double closing to close both transactions at approximately the same time.

If you want to use double closing as an investor, first you need a title company familiar with the process. This is especially important if you plan to do back-to-back closings because you have a large network of buyers.

How does it work?

- You secure temporary funding to buy the home from the seller. With your real estate expertise, you’re able to locate under-priced homes or negotiate great deals with motivated sellers.

- Still using your real estate expertise, you’ll find a buyer willing to pay the market price for the home. See the difference? You buy low and sell high – the traditional investment theory that works every time.

- Since it’s a simultaneous close, you buy the property in one closing with a separate Closing Statement and closing process, and turn around and close the next transaction, sometimes that same day and sometimes within weeks of the original closing.

- No matter when you sell the property, you’ll always be on the chain of title as an owner, no matter how brief the ownership. Once you close the B to C transaction, you use the funds to pay off your original (temporary) loan and walk away with the profits.

Interested in Double Closing?

For double closing you need transactional funding, DKC can help you to get that. Contact us for getting more details.