Fix and flip loans have become a game-changer for real estate investors looking to seize opportunities and maximize their returns. As an investor, you understand the importance of acting swiftly in the ever-changing real estate market. DKC Lending is here to provide you with tailored fix and flip loan solutions in Florida, including Tampa, Clearwater, Lakeland, and beyond. With our fast funding, maximum LTV options, and flexible terms, we empower you to make your real estate ambitions a reality.

At DKC Lending, we understand the need for speed in the world of real estate investment. Our fix and flip loans offer you the opportunity to close on your property as a “Cash” offer in as little as three days. This can give you a competitive edge, enabling you to seize lucrative opportunities while others are still caught up in lengthy financing processes.

To help make your venture financially feasible, DKC Lending provides funding for up to 70% of the purchase price. We acknowledge that the availability of capital is crucial for purchasing undervalued properties and transforming them into profitable assets. With our high LTV financing, you can confidently invest in properties that have the potential for substantial returns.

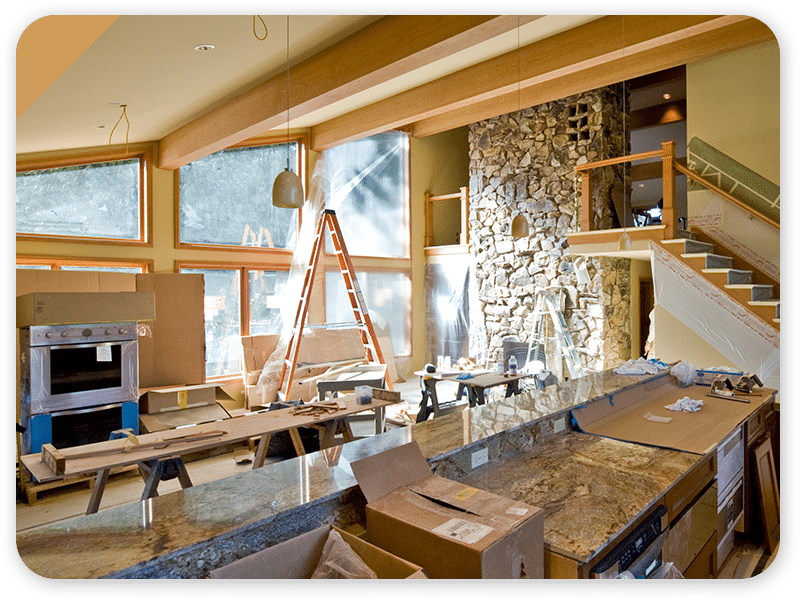

Renovations are an integral part of the fix-and-flip process. DKC Lending recognizes this and offers up to 50% financing for construction costs. This means that you not only have access to funds for purchasing the property but also for enhancing its value through necessary upgrades and repairs. Our construction cost financing ensures that you have the resources needed to transform a diamond in the rough into a lucrative investment opportunity.

To accommodate different investment strategies, DKC Lending provides flexible loan terms ranging from one to two years. This gives you the freedom to tailor your loan duration to align with your specific investment goals. Whether you prefer a shorter timeframe for a quick turnaround or need a slightly longer period to optimize your return on investment, our adjustable terms ensure that you have a financing solution that suits your needs.

We understand that profitability is the ultimate goal for real estate investors. That’s why DKC Lending offers competitive rates, with interest-only payments ranging from 10% to 12%. This allows you to allocate funds efficiently, focusing on the project at hand while minimizing the financial burden of high monthly payments. Our affordable rates ensure that your potential returns are maximized, contributing to your overall success in the fix-and-flip market.

DKC Lending believes in transparency and strives to provide a seamless borrowing experience. We charge consultation fees ranging from 2% to 4%, so you know exactly what to expect during the loan process. Our commitment to clear communication and fair pricing ensures that you can make informed decisions while minimizing unexpected costs.

Fix and flip loan is a short-term loan designed for real estate investors to purchase and improve a property to then sell for a profit. These improvements range from minor renovations to a complete reconstruction of an existing home, or construction of a new home. These loans are for investment purposes, and typically range from 6-18 months with higher interest rates.

Contact DKC Lending at +1 813-501-5729/info@dkclending.com for Fix & Flip loans in Florida.

Real estate investors or anyone buying properties at a discounts that need repairs and/or a rehab. Speed is also a big consideration, anyone needing a quick cash closings in 3-10 days.

Contact DKC Lending at +1 813-501-5729/info@dkclending.com for getting latest interest rates.

Yes, You can! Fix and Flip loans with DKC Lending are collateral backed mortgages. With equity, and/or liquidity you can get a fix and flip loan with no prior experience. DKC offers FREE consulting with their borrowers to help guide them through the real estate transaction.

You can find fix and flip properties through MLS, Wholesalers, Networking, Direct Mail, Public Records, Auction, For sale by Owners, Online Searches, Contractors And Builders, etc.

Real estate investment, particularly in the fix and flip market, offers incredible potential for wealth accumulation. With DKC Lending’s fix and flip loans in Florida, including Tampa, Clearwater, Lakeland, and beyond, you can capitalize on market opportunities quickly and effectively. Our fast funding, high LTV, flexible terms, competitive rates, and transparent consultation fees make us your trusted partner in achieving success in the real estate investment world. Let DKC Lending be your gateway to profitable investing — contact us today to explore how we can help turn your visions into reality.

"*" indicates required fields

DKC Lends Hard Money in:

COPYRIGHT © 2024 – DKCLENDING.COM